Every project manager has a story about the one risk that got away—the budget that ballooned overnight, the vendor that ghosted at the last moment, or the critical milestone derailed by something as mundane as a misplaced document.

That’s exactly why a risk management plan isn’t a nice-to-have; it’s the difference between putting out fires and preventing them altogether.

I’ve seen how uncertainty isn’t just about numbers on a spreadsheet, but also those sleepless nights, anxious stakeholders, and teams scrambling at the eleventh hour. Risks don’t knock politely; they barge in. Without a structured plan, even the best projects can unravel.

With the right framework, tools, and mindset, project managers can stop feeling like firefighters and start acting like architects of resilience. This blog will discuss all that and more.

What Is Risk Management in the Context of Project Management?

Risk management is the structured process of identifying, analyzing, and addressing potential threats or opportunities that could affect a project’s success. These risks may stem from resource shortages, technical failures, shifting priorities, or external factors like market fluctuations.

Instead of waiting for issues to occur, risk management encourages proactive planning so teams can minimize negative impacts and maximize positive outcomes. The process typically involves creating a risk management plan that documents all identified risks, their likelihood, potential impact, and strategies for handling them.

For example, consider a construction project where weather delays are a high-probability risk. A solid risk management plan would outline preventive actions (like scheduling weather-sensitive tasks earlier) and contingency measures (such as arranging backup indoor work).

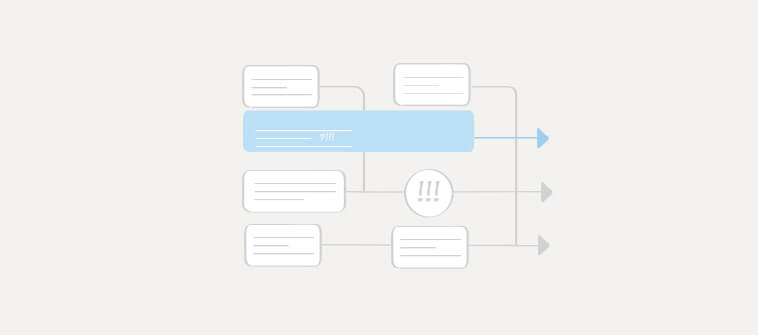

Let me show a real-world example of how Cleveland State University uses a project risk management system to track and focus on our projects, and stay organized:

Why Is It Important to Implement a Risk Management Plan?

A well-structured risk management plan is more than just a safeguard; it’s a roadmap that helps project managers anticipate problems before they derail timelines or budgets.

Here are five reasons why it matters:

1. Minimizes Project Failures

By identifying risks early, project managers can prevent issues from spiraling into costly failures, keeping projects on track.

2. Improves Decision-Making

With qualitative and quantitative assessments in place, managers make smarter, data-driven decisions instead of reacting blindly when problems occur.

3. Protects Budgets & Timelines

Clear response strategies (avoid, mitigate, transfer, accept) reduce cost overruns and delays, ensuring resources are used efficiently.

4. Builds Stakeholder Confidence

A transparent plan that communicates risks and solutions reassures clients, executives, and team members that the project is under control.

5. Ensures Compliance & Accountability

Documented processes and controls help meet industry regulations, while assigned risk owners ensure accountability throughout the project lifecycle.

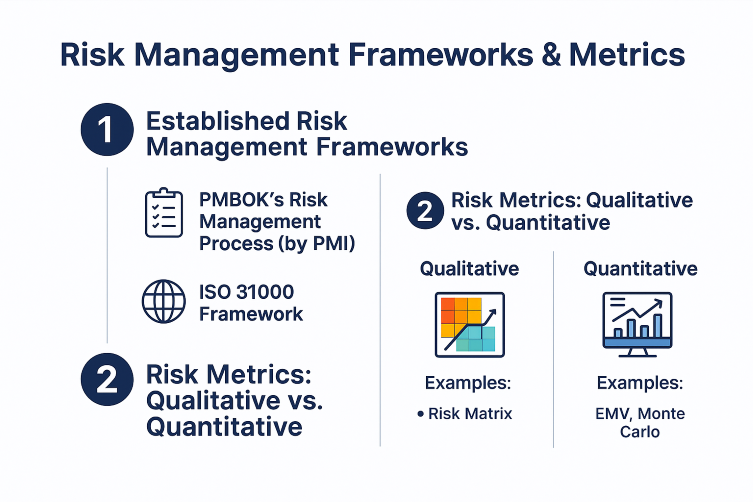

What Are Risk Management Frameworks & Metrics?

Risk management in project management isn’t about guesswork but following established frameworks and using measurable metrics to evaluate uncertainty.

By combining proven methodologies with both qualitative and quantitative approaches, project managers can systematically anticipate, assess, and mitigate risks.

1. Established Risk Management Frameworks

Two of the most recognized frameworks in the industry are:

- PMBOK’s Risk Management Process (by PMI)

This framework lays out a structured, step-by-step approach: identify risks, perform qualitative and quantitative assessments, plan responses, implement strategies, and monitor risks continuously.

It’s widely used because it aligns with core project management workflows and integrates seamlessly into planning cycles.

- ISO 31000 Framework

Unlike PMBOK, which is project-specific, ISO 31000 is a broader risk management standard that can be applied across industries.

It emphasizes creating principles, frameworks, and processes that support decision-making at every organizational level.

This approach is especially valuable for enterprises managing multiple projects with interconnected risks.

2. Risk Metrics: Qualitative vs. Quantitative

Metrics are the backbone of effective risk management, helping managers evaluate both the likelihood and impact of risks.

- Qualitative Metrics

This method is used when risks are uncertain or data is limited. Tools like risk matrices help teams classify risks as low, medium, or high by plotting likelihood vs. impact.

It is faster, easier, and ideal for projects in early planning stages.

- Quantitative Metrics

Applied when numerical data is available, providing a more precise picture of potential outcomes. Examples include:

- Expected Monetary Value (EMV): Calculates the financial impact of risks by multiplying probability by impact.

- Monte Carlo Simulation: Uses thousands of random iterations to predict probability distributions for project timelines and budgets.

- Sensitivity Analysis (Tornado Diagrams): Highlights which risks have the most significant influence on project outcomes.

3. When to Use Each Approach

- Use qualitative metrics for smaller projects, early-stage assessments, or when time/resources are limited.

- Use quantitative metrics for complex projects with high stakes, large budgets, or when precise financial/technical forecasts are needed.

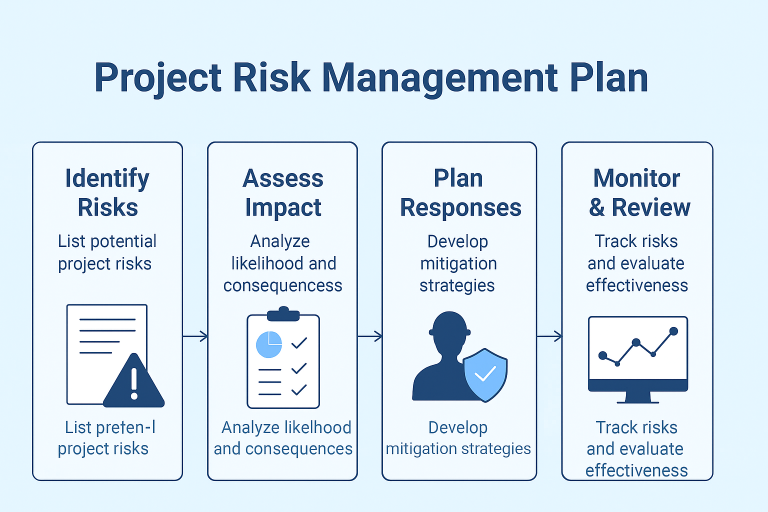

How to Create a Comprehensive Risk Management Plan

A strong risk management plan provides structure and ensures that risks are identified, evaluated, addressed, and communicated effectively.

To make it actionable, each section of the plan should serve a distinct purpose and connect directly to project goals.

1. Risk Identification

This is the foundation of the plan. It involves listing all potential risks, whether technical, financial, operational, or external. For example:

- Scope Creep: The project’s goals expand beyond the original agreement, leading to delays and budget issues.

- Insufficient Resources: The team lacks the necessary people, skills, or budget to complete the project.

- Poor Communication: Misunderstandings between the team and clients cause confusion and rework.

- Technology Issues: The tools or software chosen for the project fail or are incompatible with client systems.

- Unrealistic Timelines: An aggressive schedule leads to rushed work, errors, and team burnout.

Techniques like brainstorming sessions, expert interviews, and SWOT analysis are often used. The output is a risk register that becomes the single source of truth for all project risks.

2. Qualitative & Quantitative Risk Assessment

After identifying risks, the next step is to analyze their likelihood and impact.

- Qualitative methods (like risk matrices) classify risks as low, medium, or high.

- Quantitative methods (like Monte Carlo simulations or Expected Monetary Value analysis) provide measurable financial or timeline impacts.

This step helps prioritize risks so resources aren’t wasted on minor threats.

3. Risk Response Strategies

This section outlines the actions you’ll take to handle risks, typically falling into four categories:

- Avoidance: Change the plan to eliminate the risk.

- Mitigation: Reduce the probability or impact.

- Transfer: Shift responsibility to a third party (e.g., insurance or outsourcing).

- Acceptance: Acknowledge the risk and plan contingencies.

Each risk in the register should have a clear response strategy with owners assigned.

4. Create an Action Plan

Once you have assigned risk owners, it’s time to develop a risk management plan. The outline of the plan will consist of preventative measures that will help prevent risks from arising. These measures can take two forms.

First, identify the actions to take when you spot a risk. Second, identify ways to improve or enhance project execution so that risks are less likely to be encountered. This plan is crucial because it will equip you with strategic action to minimize the potential impact of a risk.

For example, you can adopt a risk management software to ensure optimum team communication and efficiency throughout the project. This software will enable you to conveniently develop and implement your risk contingency plan using its simple and intuitive interface.

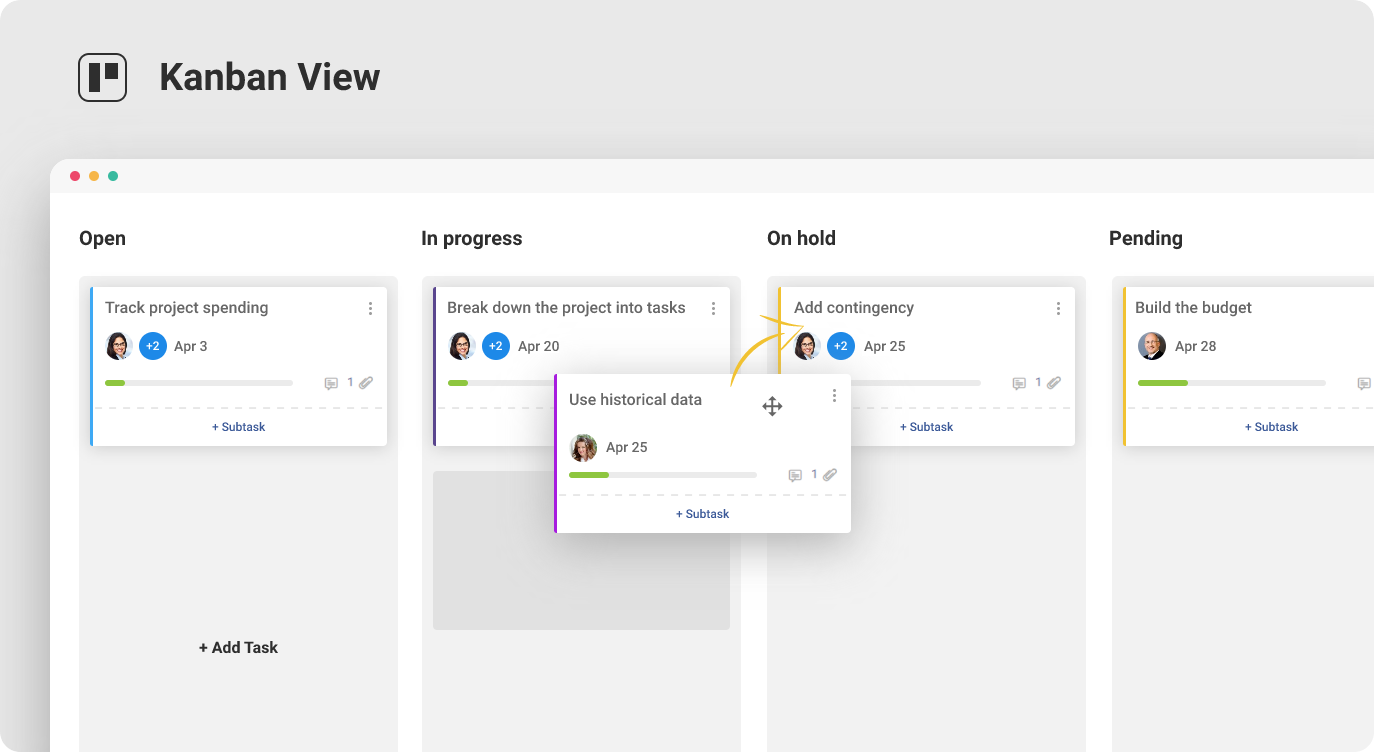

Onboarding a software will allow you to:

- Handle multiple projects simultaneously on a single platform

- Visualize progress in real-time using Gantt charts, Kanban boards, and more

- Gain key project metrics via insightful reports

- Give feedback for tasks via task comments

- Share files on the go

- Adjust workflows with a quick drag and drop.

Thus, a strong action plan is armed with strategic practices and reliable risk management software to tackle risks and deliver successful projects.

5. Prepare a Backup Plan

Risks often emerge when you’re least expecting them. So, it’s only wise that you have a backup plan in your arsenal.

This should consist of alternate measures to take when a risk arises, and a robust risk management software you can use to manage your plan of action.

6. Monitoring & Control

Risks evolve throughout the project lifecycle, so ongoing monitoring is essential. This includes regular reviews of the risk register, updating assessments, and checking whether mitigation strategies are effective. Dashboards and KPIs help track trends in real time.

7. Stakeholder Communication

Transparent communication builds trust and prevents surprises.

The plan should define how risks are reported, the frequency of updates, and which stakeholders need to be informed at different risk levels.

This ensures everyone, from project teams to executives, stays aligned.

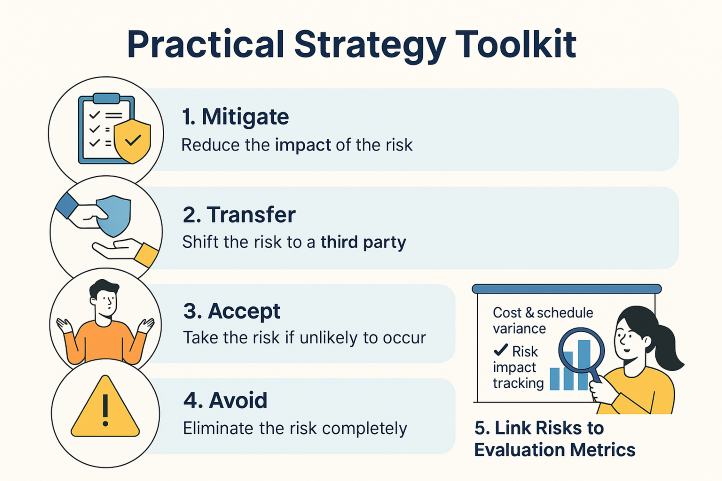

Practical Strategy Toolkit

Managing risks isn’t just about spotting them; it’s about having a clear playbook for how to act when they arise.

A practical strategy toolkit equips project managers with actionable steps and measurable ways to stay in control.

1. Mitigate

When the likelihood of a risk is high, focus on reducing its impact.

Example:

If a software rollout faces delays due to resource shortages, hire temporary contractors or redistribute workloads.

How to Measure:

Track schedule variance and compare planned vs. actual delivery dates to confirm if mitigation is effective.

2. Transfer

Shift the risk responsibility to a third party through contracts or insurance.

Example:

A construction firm might outsource hazardous material handling to a specialized vendor.

How to Measure:

Use cost variance reports to assess whether the transfer saved money compared to handling the risk internally.

3. Accept

For low-impact or low-likelihood risks, acceptance is often the most efficient approach.

Example:

A minor risk of printer downtime in a small office can be logged but not acted upon.

How to Measure:

Maintain a risk impact log that quantifies the financial/time cost of accepted risks to ensure they remain within tolerance.

4. Avoid

If the risk could have severe consequences, remove the activity that causes it.

Example:

Canceling a risky feature launch that has unclear compliance guidelines.

How to Measure:

Evaluate risk probability reduction by tracking how removing the risky activity affects overall project risk exposure.

5. Link Risks to Evaluation Metrics

Every response strategy must tie back to measurable criteria:

- Cost Variance (CV): Did risk response save or overspend resources?

- Schedule Variance (SV): Did it reduce project delays?

- Risk Impact Tracking: Are residual risks staying within acceptable limits?

- Quality Metrics: Did mitigation/avoidance improve deliverable quality?

By pairing each response with metrics, project managers not only control risks but also demonstrate the ROI of risk management decisions.

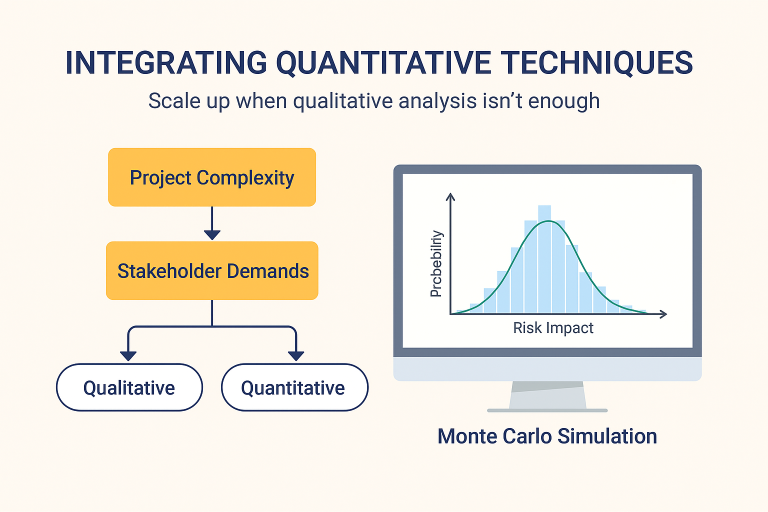

How to Integrate Quantitative Techniques

Qualitative risk analysis, like using probability and impact ratings, is often enough for smaller or lower-stakes projects.

But when projects become highly complex, involve significant budgets, or stakeholders demand precise forecasts, it’s time to scale up to quantitative techniques.

These methods add mathematical rigor to your risk plan and provide hard data for decision-making.

When to Scale Up

Move from qualitative to quantitative analysis when:

- The project has major financial exposure or tight deadlines.

- Stakeholders require statistical confidence in forecasts.

- Risks have cascading effects across departments or vendors.

- Regulatory or compliance standards demand precise modeling.

Quantitative Tools & Methods

- Risk Matrices: A visual method to prioritize risks, often used as a bridge between qualitative and quantitative stages.

- Monte Carlo Simulations: Run thousands of scenarios to predict the probability of cost overruns, schedule delays, or resource shortages.

- Expected Monetary Value (EMV): Assigns a dollar value to risks by multiplying probability × impact, helping managers compare risk-response strategies.

Practical Example

Imagine a $5M construction project facing uncertainty in material costs. A Monte Carlo simulation could model price fluctuations across hundreds of possible market conditions, producing a confidence interval for the final budget.

This data allows managers to decide whether to hedge costs, renegotiate contracts, or allocate contingency reserves, grounding risk responses in measurable outcomes.

By integrating these quantitative methods into your risk management toolkit, project managers can back up decisions with data, build stakeholder trust, and keep projects aligned with financial and scheduling goals.

Emotional & Cultural Dimensions of Risk Management

Risk management isn’t just about frameworks and metrics but also about how teams and stakeholders feel about risk.

Stress, anxiety, or lack of trust can derail even the most well-designed plans. Here’s how to address the human side of risk management:

- Share transparent reports so teams and stakeholders feel informed instead of blindsided.

- Conduct regular risk workshops to surface concerns, align strategies, and build collective responsibility.

- Use visible risk dashboards to keep risks front and center, increasing transparency and trust.

- Encourage open communication so team members can voice anxieties before they escalate.

- Reinforce a culture of collaboration where risk management is seen as shared ownership, not top-down control.

Reduce Project Risks With a Comprehensive Risk Management Plan

Every project carries uncertainty, but a well-structured risk management plan transforms potential setbacks into manageable challenges. From identifying risks early to applying proven frameworks, response strategies, and metrics, project managers can safeguard timelines, budgets, and team morale.

The solution lies not just in theory but in practical, actionable steps—integrating qualitative and quantitative methods, addressing emotional and cultural dimensions, and embedding risk management into daily workflows. With clear strategies and measurable metrics, risks become less intimidating and far more controllable.

ProProfs Project, with its AI-powered insights, automated workflows, time tracking, and visual dashboards, helps project managers anticipate risks, assign ownership, and monitor performance in real time. Its intuitive platform makes risk management not just a safeguard but a growth enabler—helping teams deliver projects faster, smarter, and with confidence.

FREE. All Features. FOREVER!

Try our Forever FREE account with all premium features!