If you’re an accountant or a project manager, you may be familiar with the term “accounting project management.” But what exactly does it mean, and why is it so important?

Accounting project management involves the comprehensive process of planning, tracking, and analyzing the costs, revenue, and billing associated with a project. Its primary objective is to ensure that your project achieves its financial goals and delivers value to your clients.

Adopting specialized tools and developing the necessary skills empower you to effectively navigate the complexities of everyday management. You learn to break down large tasks into smaller, manageable ones, allocate resources and budgets with precision, and craft clear and concise summaries of financial results.

Accounting project management can significantly enhance your efficiency, profitability, and overall customer satisfaction. Moreover, it serves as an effective strategy to avoid common pitfalls, such as scope creep, cost overruns, and compromised quality.

In this blog, we will explore what accounting project management is, its benefits, and challenges along with some proven tips.

What Is Accounting Project Management?

Accounting project management merges financial expertise with project management principles. It ensures financial goals are met and clients receive tangible value.

Its key components include financial planning, budget control, risk assessment, and insightful reporting. This approach overcomes challenges like scope creep, cost overruns, and missed deadlines. It drives efficiency, profitability, and customer satisfaction in finance and project management.

The main focus of accounting professionals is on financial forecasting, cost-benefit analysis, variance analysis, and financial performance evaluation. By integrating financial metrics and expertise, accounting project management optimizes resource allocation, mitigates risks, and enhances financial governance.

Overall, accounting project management enables you to achieve financial objectives through effective planning, control, and reporting.

But what are the proven benefits of accounting project management?

Let’s find out!

What Are the Benefits of Accounting Project Management?

Explore the benefits of project management in the accounting field, where it revolutionizes financial control, risk mitigation, and decision-making processes.

- Financial Control: Accounting project management ensures strict financial control throughout the project lifecycle, minimizing risks and preventing budget overruns.

- Accurate Financial Reporting: It enables accurate and timely financial reporting. This helps provide stakeholders with transparent and reliable financial information for decision-making.

- Effective Resource Allocation: Accounting project management optimizes resource allocation, ensuring that resources are efficiently utilized and aligned with project objectives.

- Mitigation of Financial Risks: It helps identify and mitigate financial risks, such as market volatility, regulatory compliance, and financial fraud, safeguarding the organization’s financial integrity.

- Streamlined Financial Processes: It streamlines financial processes, reducing redundancies, improving efficiency, and ensuring compliance with accounting standards and regulations.

- Improved Financial Analysis: It provides robust financial analysis capabilities, enabling organizations to assess profitability, return on investment, and financial viability of projects.

- Enhanced Decision-Making: Project management in accounting empowers decision-makers with accurate and relevant financial data, facilitating informed and strategic decision-making.

So these were the major benefits of accounting project management which can revolutionize your financial operations.

Now, there are also some principles that accounting project management swears by. Let’s see what they are.

Unleashing the Dynamic Principles of Accounting Project Management

Accounting project principles serve as guiding pillars for accountants in effectively managing project finances. By implementing robust processes aligned with these principles, you can unlock financial success and make informed decisions.

Cost Principle

The cost principle highlights the importance of recording project costs based on their historical or original value. It ensures that financial statements reflect the actual expenses incurred during the project’s lifespan. By following this principle, you can assess the profitability and viability of projects.

For instance, when purchasing new equipment for a construction project, the cost principle necessitates recording the equipment’s acquisition cost rather than its current market value.

Matching Principle

The matching principle aims to align project revenues with the associated expenses in the same accounting period. It helps report a project’s financial performance accurately by following revenue recognition standards that involve recording income when it’s earned and matching it with related costs.

For example, a software development project that generates licensing revenue should recognize the associated expenses, such as development costs and marketing efforts, during the same period to present a clear view of profitability.

Consolidation Principle

The consolidation principle applies when an organization manages multiple projects simultaneously. It involves consolidating the financial data of all related projects to provide a holistic view of the organization’s financial position.

This way, you can gain insights into resource utilization, revenue streams, and overall project performance. This principle allows stakeholders to evaluate the collective impact of projects on the organization’s financial health.

Full Disclosure Principle

The full disclosure principle emphasizes transparency and requires businesses to provide all relevant information regarding their projects in financial statements. This principle ensures that users of financial statements have complete and accurate information to make informed decisions.

By disclosing essential project details, such as contingent liabilities, project risks, and commitments, you can enable stakeholders to evaluate the potential impact on future financial outcomes.

Prudence Principle

The prudence principle encourages a cautious approach to project accounting. It requires you to exercise judgment when evaluating uncertain events and transactions with the help of project accounting software.

Under this principle, you need to prioritize caution by promptly recognizing potential losses and only acknowledging gains once they are realized.

By doing so, you can avoid overstating project performance and gain a realistic representation of your financial position.

Liability Principle

The liability principle emphasizes the accurate recognition and measurement of project-related liabilities. It ensures that financial statements reflect an organization’s obligations and commitments arising from the project.

For example, when managing a construction project, it’s essential to consider potential warranty claims, legal disputes, and outstanding payments to contractors. This approach ensures a comprehensive and accurate representation of the project’s financial status.

Control Principle

The control principle emphasizes the importance of establishing strong internal controls within project management processes. It involves implementing checks and balances to safeguard project assets, ensure accuracy in financial reporting, and prevent fraudulent activities.

By utilizing this course of action, you can instill confidence in stakeholders and minimize the risk of errors or misinterpretations in financial statements.

Resource Allocation Principle

The resource allocation principle emphasizes the efficient and effective utilization of project resources. It involves allocating resources, such as labor, materials, and equipment, to projects based on their needs and priorities.

By optimizing resource allocation, you can enhance project profitability, minimize waste, and deliver projects within budget and timeline.

While discussing accounting, project management, and their various aspects, you may wonder

Is project management accounting different from traditional accounting?

Let’s delve into this in the next section.

Project Management Accounting vs. Traditional Accounting

In the world of accounting, two approaches vie for dominance: project management accounting and traditional accounting. While traditional accounting focuses on financial reporting and compliance, project management accounting takes a holistic approach by incorporating project-centric elements.

First, traditional accounting primarily revolves around tracking financial transactions and preparing financial statements. In contrast, project management accounting integrates project-centric elements, such as project costs, resource utilization, and profitability.

This comprehensive approach provides a deeper understanding of each project’s financial impact and enables informed decisions to optimize outcomes.

Second, project management accounting emphasizes granular cost tracking, allowing you to monitor project expenses at a detailed level. It goes beyond traditional accounting’s general cost categorization and offers insights into specific cost drivers. This empowers you to identify opportunities for cost savings and maximize project profitability.

Third, while traditional accounting relies on static budgets and forecasts, project management accounting offers dynamic budgeting and forecasting capabilities. By incorporating real-time data and adjusting projections as you track projects progress, you can make accurate financial decisions and mitigate risks effectively.

And fourth, project management accounting optimizes resource allocation by taking into account the financial implications of resource utilization. It incorporates project-specific factors, such as resource availability, skill sets, and timelines, to ensure optimal resource allocation and enhance project efficiency.

What more? Well, project management accounting delivers real-time reporting, performance analysis, and project profitability analysis. And by monitoring key performance indicators and assessing profitability at the project level, you can proactively address issues, identify opportunities for improvement, and make strategic decisions based on real-time data.

So while traditional accounting serves as a foundation for financial compliance, project management accounting takes accounting to the next level.

Now that you are familiar with the difference between the two concepts, let’s check out the various challenges of accounting project management.

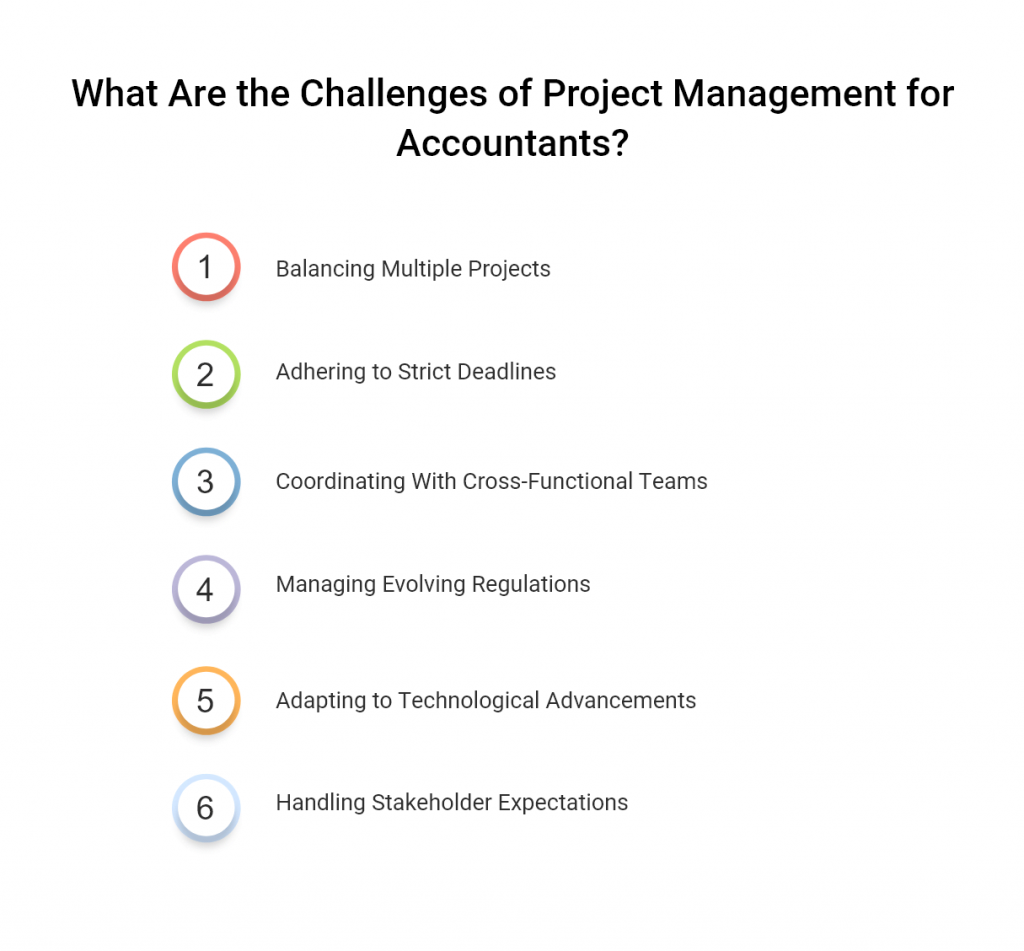

What Are the Challenges of Project Management for Accountants?

While accounting brings numerous benefits, it also presents unique challenges for project management for accountants. Recognizing and proactively addressing these challenges can helps accountants navigate the roadblocks with confidence.

Balancing Multiple Projects

Accountants often find themselves responsible for handling multiple projects

simultaneously.

Each project comes with its own specific requirements, timelines, and stakeholders. Juggling various tasks can lead to conflicting priorities and potential mistakes.

For instance, an accountant may need to handle tax filings for multiple clients while simultaneously manage financial audits for different companies.

Adhering to Strict Deadlines

The accounting profession thrives on strict deadlines, and project management is no exception.

Accountants must be adept at managing time effectively to ensure that projects are completed within the specified timeframes. Failure to meet deadlines can have severe consequences, such as incurring penalties or damaging client relationships.

For instance, missing a tax filing deadline can result in costly fines for both the accountants and their clients.

Read More: 10 Task Management Tips for Higher Productivity

Coordinating With Cross-Functional Teams

Project management for accounting firms often involves collaborating with cross-functional teams, including auditors, tax specialists, and finance professionals.

Aligning efforts, ensuring effective communication, and maintaining synergy among team members can be challenging.

For example, accountants working on an ERP implementation project may need to coordinate with IT specialists, financial analysts, and operational staff to ensure seamless integration and accurate financial reporting.

Read More: Team Collaboration Strategies You Need to Adopt Right Now

Managing Evolving Regulations

Accountants operate in a highly regulated environment, where compliance with ever-changing laws and regulations is paramount.

Project management entails staying up-to-date with the latest accounting standards and ensuring that projects adhere to relevant regulations. Failure to comply can result in legal repercussions and reputational damage.

An example would be managing a project to implement new revenue recognition standards (such as ASC 606) within a specific timeline and ensuring all transactions are accounted for correctly.

Adapting to Technological Advancements

With the rise of digital transformation, accountants must navigate an ever-evolving technological landscape.

Implementing accounting software, utilizing automation tools, and leveraging data analytics require accountants to be tech-savvy project managers.

For instance, managing a project to migrate financial data from legacy systems to cloud-based accounting software can pose challenges related to data security, training, and process reengineering.

Handling Stakeholder Expectations

Successful project management entails effectively managing stakeholder expectations.

Accountants often face the challenge of balancing the demands and requirements of multiple stakeholders, including clients, regulators, executives, and internal teams.

For example, managing a financial reporting project may involve reconciling differing expectations of the finance team, auditors, and company management.

Accounting project management demands a delicate balance between numbers and organizational skills. By acknowledging and addressing these challenges head-on, accountants can elevate their project management skills and deliver exceptional results.

Do you know there are some useful tips and best practices that aid accounting project management and help avoid these common challenges?

Check them out next!

Accounting Project Management: Tips & Best Practices

Here, we will explore key accounting project management best practices that can transform your approach to project execution.

Leverage Cloud-based Accounting Software

Utilizing cloud-based project accounting software like ProProfs Project is a game-changer for accounting project management.

It allows real-time collaboration, centralized data storage, and automated financial processes. With features like expense tracking, invoicing, and financial reporting, you can gain better visibility into project finances, simplify administrative tasks, and make data-driven decisions with ease.

We’ll delve deeper into how a software supports accounting project management in detail in the next section.

Establish Clear Project Goals & Objectives

Clearly defining project goals and objectives is vital for effective accounting project management. It provides a roadmap for project teams and aligns their efforts with the desired outcomes. By setting SMART goals, you can ensure that financial resources are allocated appropriately and progress is monitored accurately.

Develop a Detailed Project Budget

A well-structured project budget plan outlines projected costs, revenue streams, and cash flow requirements throughout the project lifecycle. When you meticulously estimate expenses, such as labor, materials, and overheads, you can proactively identify potential cost overruns, make necessary adjustments, and maintain financial control throughout.

Implement Robust Project Cost Tracking

Accurate and timely tracking of project costs is essential for smooth accounting project management. By implementing a reliable cost tracking system, you can monitor expenditures against the budget, identify cost variances, and take corrective actions on time.

This practice enables you to stay within budget and optimize resource allocation for maximum efficiency.

Conduct Regular Financial Performance Reviews

Regular financial performance reviews provide insights into the project’s financial health and progress. By analyzing key performance indicators (KPIs), such as revenue, expenses, profitability, and return on investment (ROI), you can identify areas for improvement, mitigate risks, and ensure that the project remains on track.

These reviews empower you and other project stakeholders to make informed decisions based on financial information.

Maintain Effective Communication & Collaboration

As a project manager, you should foster open channels of communication. This ensures that financial information is shared transparently and potential challenges are addressed promptly.

Regular meetings, status updates, and collaborative platforms help streamline financial workflows and build a cohesive project team.

Mitigate Financial Risks

To identify and mitigate financial risks, you should conduct comprehensive risk assessments. Evaluate the potential impact of financial risks on project outcomes, and develop risk mitigation strategies.

By proactively managing financial risks, such as budget overruns, cash flow disruptions, or market fluctuations, you can safeguard project profitability and sustainability.

Continuously Learn & Improve

Embracing a culture of continuous learning and improvement for accounting project management success. You should evaluate project performance, gather feedback from stakeholders, and identify lessons learned for future projects.

By leveraging these insights from previous experiences, you can refine financial processes, optimize resource allocation, and drive better outcomes in subsequent projects.

Let’s now dig into how you can make the most of a software to ace accounting project management.

How Can the Right Project Management Software Boost Your Accounting Process

Using a project accounting software, you can:

- Centralize project information

- Foster real-time collaboration and communication

- Automate repetitive tasks

- Improve accuracy and data integrity

- Enhance project visibility and tracking

Managing accounting projects can be a complex task, requiring careful planning, efficient resource allocation, and effective communication.

Thankfully, software solutions designed specifically for accounting project management can streamline and enhance these processes, providing numerous benefits to businesses.

Let’s explore how a software can support accounting project management.

Project Planning & Task Management

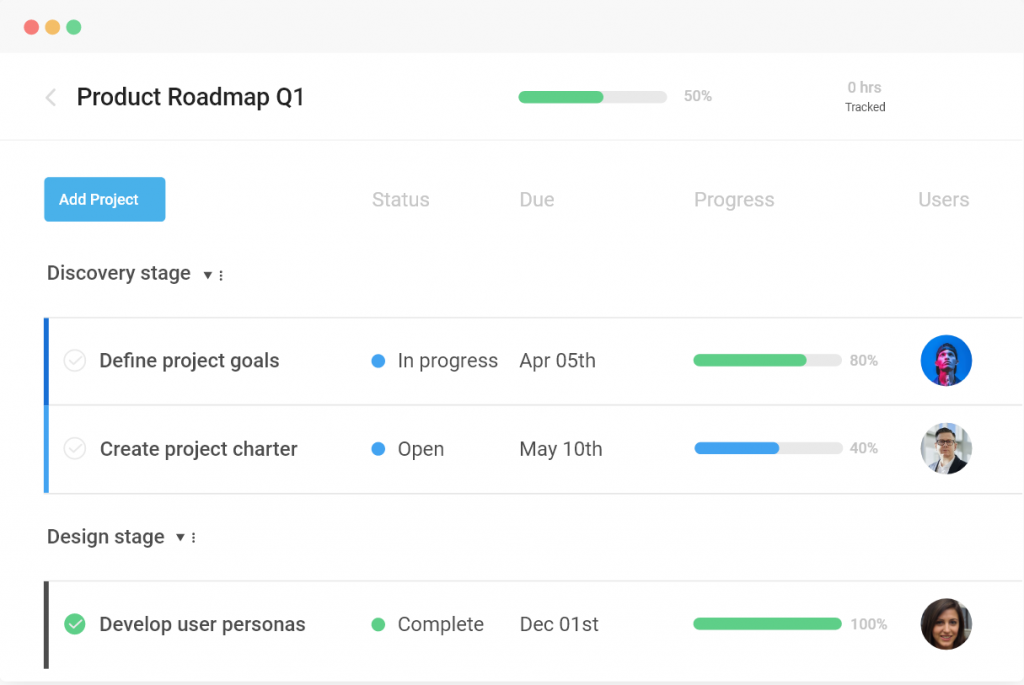

A robust accounting project management tool allows you to efficiently plan and manage tasks across multiple projects. The best part is that you can tailor the software to suit your specific needs.

You can either create a dashboard from scratch or use a custom template that fits your requirements. These are some of the templates that ProProfs offers.

The comprehensive project dashboards help gain visibility into all active projects, ensuring nothing falls through the cracks. They help you track progress, set deadlines, and assign responsibilities with ease, keeping your projects organized and on track.

Resource Allocation & Optimization

The right software solution provides easy-to-use dashboards and visual charts that offer insights into resource availability and utilization. By allocating resources to tasks, you can ensure that every team member is effectively contributing to the project’s success.

With real-time visibility into resource allocation, you can avoid underutilization or overutilization, maximizing efficiency.

Here is an example of a dashboard giving a quick glance of which users are allocated to which tasks and their ongoing status.

Also, using a tool enables you to track productivity via time entries.

When your team members are assigned tasks, the first thing they should do when they start working on a task is to click the little timer icon in the Time column. This creates an active time entry which is updated when they stop the timer. At this point they can also add a description of what they were working on specifically.

Budgeting & Cost Control

Using a software, you can track and forecast data. This empowers you to control your budget and ensure project profitability. You can also generate comprehensive project profitability reports to evaluate the financial health of each project, identify areas of improvement, and make informed decisions.

With better control over costs, you can maximize the return on investment for your accounting projects!

This is how a project profitability reports looks like:

The project profitability report lets you track your project expenditure compared to your budget allocation. It provides a detailed overview of total costs incurred versus your set budget and displays your profit margin.

Team & Stakeholder Communication

An accounting software solution provides features that facilitate seamless collaboration and communication among team members and stakeholders. Task comments allow for easy exchange of feedback, ensuring clarity and alignment.

Here’s an example!

Also, the ability to share files on the go ensures everyone has access to relevant documents and resources. Additionally, staying up to date with workflows and progress helps foster transparency and accountability.

Overall, a tool offers a centralized communication hub that allows team members to collaborate efficiently, resolve queries, and share updates in real time, improving overall project coordination and productivity. Plus, you can also share project files easily and connect the project management tool with Dropbox, Google Drive, Box, etc. to make communication within teams seamless.

Data-Driven Insights

Data-driven insights are invaluable for effective decision making in accounting project management. The right software solution offers Summary reports that consolidate project data, enabling you to gain a holistic view of project performance.

Additionally, Comments reports provide valuable feedback and suggestions from team members and stakeholders, further enhancing decision-making capabilities.

This is how a Summary report looks like in ProProfs:

Uncomplicate Your Finances by Simplifying Accounting project management

Accounting project management plays a crucial role in ensuring the smooth execution of projects while maintaining financial control and accountability. By implementing effective practices, you can enhance your project management processes, streamline financial workflows, and achieve project success.

Adopt a good project management accounting software that offers all the essential budget control and task management features. You will see that a lot of your recurring tasks are offloaded, and you will have more time to focus on the financials.

Uncomplicate your finances today and experience the ease and efficiency of accounting project management!

FREE. All Features. FOREVER!

Try our Forever FREE account with all premium features!